Beau Beaullieu

Badges Earned

Endorsements

,

,

Major Donors

Notable Efforts

- Voted against HB267 (2023 Regular Session) seeking a moratorium on Carbon Capture projects in Lake Maurepas.

- Voted in favor of SB1 (2024 Extraordinary Session) "Constitutional Carry" to allow law-abiding citizens to carry concealed handguns lawfully without a permit

- Voted in favor of SB2 (2024 Extraordinary Session) relative to liability for persons authorized to carry a concealed handgun

- Voted in favor of HB1 (2024 Extraordinary Session) to create the Truth and Transparency in the Louisiana Criminal Justice System Program

- Voted in favor of HB2 (2024 Extraordinary Session) to provide for immunity from civil liability under certain circumstances for peace officers and public entities that employ or appoint peace officers

- Voted in favor of HB4 (2024 Extraordinary Session) to provides relative to changes for post conviction relief procedures

- Voted in favor of HB9 (2024 Extraordinary Session) to provides relative to parole

- Voted in favor of HB9 (2024 Extraordinary Session) to provides relative to diminution of sentence

- Voted in favor of HB23 (2024 Extraordinary Session) to provide with respect to procedures for challenging the constitutionality of a statute or law

- Voted against HB866 (2024 - Regular Session) to provide relative to the refusal of certain medical services.

- Voted against HB743 (2024 - Regular Session) to provide for absentee voting by mail by qualified incarcerated voters.

- Voted against HB550 (2024 - Regular Session) to terminate approval of home study programs by the State Board. of Elementary and Secondary Education (BESE), provides for the enrollment of students in home schools, and provides for one-time notification to BESE upon such enrollment.

- Voted against HB288 (2024 - Regular Session) to provide relative to the inclusion of immunization records on autopsy reports of infants.

- Co-sponsored HB17 (2024 1st Extraordinary Session) to provide for closed party primary elections for certain offices.

- October 14, 2023 - Elected to the Louisiana House of Representatives (District 48) receiving 85% of the vote.

- 2023 - Received a 100% Pro-Life Voting Record with Louisiana Right to Life as a State Legislator and answered the Louisiana Right to Life Questionnaire 100% Pro-Life.

- Introduced HB142 (2023) to provide for the termination of custodial property at 25 years of age under the Uniform Transfer to Minors Act

- Introduced HB154 (2023) to establish corporate and individual income tax exemptions for certain veteran-owned businesses

- Introduced HB171 (2023) to revise certain conditions under which marketplace facilitators are required to collect and remit state and local sales and use tax on remote sales

- Introduced HB241 (2023) to change the rates and brackets for purposes of calculating income tax for individuals, estates, and trusts from a graduated rate system to a single flat rate of 3.49%

- Introduced HB260 (2023) to prohibit the implementation of federal election directives and guidance and spending of federal money for elections under certain conditions.

- Introduced HB386 (2023) to establish the Strong Louisiana Families Tax Credit for donations to certain charitable organizations designated by the Dept. of Children and Family Services; repeals a tax deduction for private infant adoptions and replaces it with a tax credit

- Introduced HB558 (2023) to move responsibility for the management and supervision of the uniform electronic local return and remittance system from the Dept. of Revenue to the La. Uniform Local Sales Tax Board and requires the board to design and implement a single remittance system whereby each taxpayer can remit state and local sales and use taxes through a single transaction

- Introduced HB622 (2023) to provide that for each taxable year beginning on or after Jan. 1, 2023, increases the net operating loss deduction from 72% to 100% of a corporation's net operating loss carryovers to that year

- Introduced HB629 (2023) to provide a local sales and use tax exemption for the procurement and administration in medical clinics of prescription drugs administered by topical system

- Introduced HB657 (2023) to provide relative to administration of a tax deduction for adoption of children from foster care and a tax credit for donations to foster care charitable organizations

- Introduced HB130 (2022) to require motor vehicle accident reports be made available to healthcare providers or their agents who provided healthcare services to a party that is a subject of the report

- Introduced HB359 (2022) to prohibit implementation of federal election directives and guidance and spending of federal money for elections under certain conditions

- Introduced HB374 (2022) to increase the penalties for gross littering involving tires and failure to obtain a generator identification number

- Introduced HB637 (2022) to specify that an assessor is only required to produce assessment data in usable electronic media to the tax assessor and provides for certain fees for copies of listings or assessment rolls

- Introduced HB899 (2022) to provide relative to the preemption of local ordinances regarding tobacco products

- Earned School Choice Badge for voting for HB745

Related Articles

Mid-Session Update

There is a lot happening this Legislative session from education freedom to constitutional convention. Of course we cannot write an article to cover every single bill, but here are a few we have been watching.

Constitutional Amendments – November 18, 2023

Here we go again, another election and another four constitutional amendments. What would they do and should you support them?

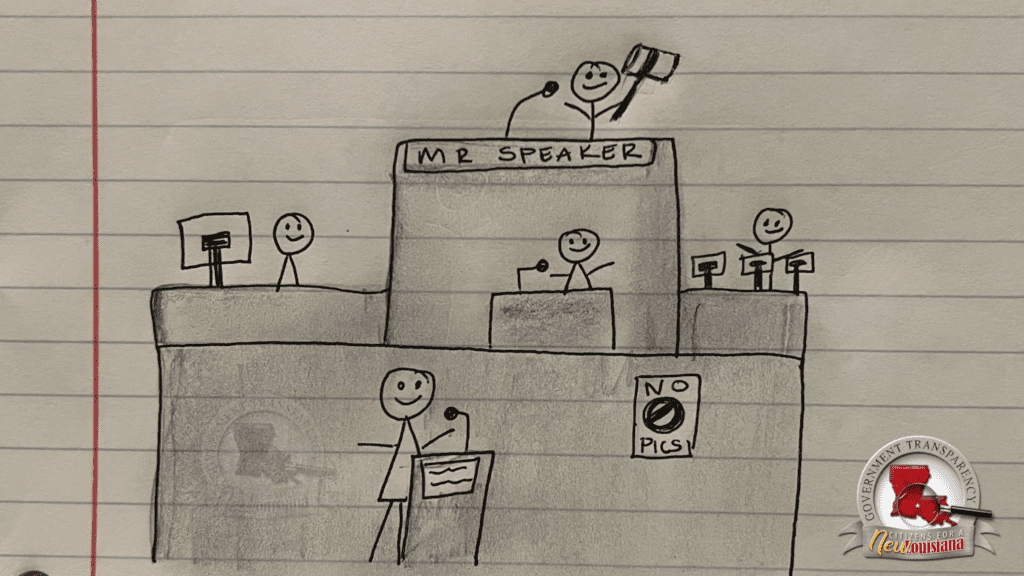

Skirting the Line

It's election season. If you weren't already prepared for the deceptive campaign ads and potential misuse of public funds to prop up certain candidates, let this be your first indication that campaign season has now officially arrived.

City of Broussard Races 2022

To fix Louisiana, start by fixing your small town government. The two competing factions in the City of Broussard are making attempts to do just that by offering the voters a unique choice. One side prefers rigorous debate in an independent council. The other side just wants to follow the Mayor's lead. In what group is your candidate?

November 8, 2022 Constitutional Amendments

We hear you. Here's our take on the eight constitutional amendments coming to Louisiana voters on November 8th, 2022.

THE CHILL REMAINS

Should the Police Association be allowed to take a position on legislation that directly affects its members? Should they be able to brag on police accomplishments and even warn the public about criminals in the area?

Yesterday's determination by the Lafayette Fire and Police Civil Service Board will have a chilling effect on exactly this kind of information. It will reduce the amount, quality, and diversity of information made available to the public. Check it out...