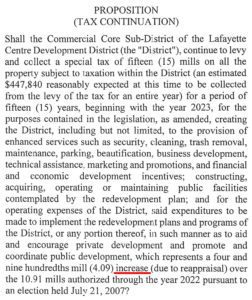

If Anita Begnaud has her preference, you’ll never find out that smack in the middle of Festival International, on April 30th, 2022, there will be an election to increase the downtown property tax by fifty-percent (50%) more than allowed by their enabling legislation (Section 5a, on page 5 of Act 194 of the 1983 regular session). According to page six of Downtown Development Authority’s 2022’s proposed budget, the tax will collect $447,840, but $423,652, a whopping ninety-five percent (95%), will be going toward “operational expenses” (salaries and operations).

Of that $423,652, the manning tables reflect that $406,348 (96%) will be in the form of direct compensation to the CEO and her three-employee inner-circle.

| Name | Title | Compensation |

|---|---|---|

| Anita Begnaud | Chief Executive Officer | $143,091.92 |

| Rachel Holland | Director of Development and Planning | $103,033 82 |

| Hunter Hebert | Operations Manager | $80,111.14 |

| Amy Trahan | Director of Finance | $80,111.14 |

| Total | $406,348.02 |

Can you trust them after a history of deception?

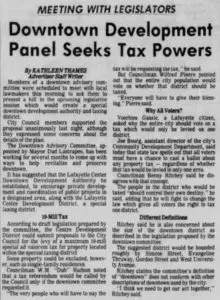

False promises, prevarications, stretching the truth are all in the same family of deception. At the time just before DDA was formed, local newspapers promised that the ad valorem (property) tax would be a “maximum of 10 mills.” We also see that language carried into the district’s enabling legislation. It says the tax is “not to exceed 10 mills.” And yet, the faded memories of promises past have allowed them to grow this tax fifty-percent (50%) to 15 mills. The new narrative? They aren’t really raising your taxes.

False promises, prevarications, stretching the truth are all in the same family of deception. At the time just before DDA was formed, local newspapers promised that the ad valorem (property) tax would be a “maximum of 10 mills.” We also see that language carried into the district’s enabling legislation. It says the tax is “not to exceed 10 mills.” And yet, the faded memories of promises past have allowed them to grow this tax fifty-percent (50%) to 15 mills. The new narrative? They aren’t really raising your taxes.

Even if we review the recent ballot language from July 21, 2007, we notice that they did sneak a little extra in there (not quite one mill). However, any reasonable person that sees “10.91 mills” and “15 years” would assume that they’ll be paying 10.91 mills for the entire fifteen (15) years, right?

Except, that’s not what has happened at all. They are now taxing private businesses downtown 150% of their original authorization. In fact, these ballooning increases are quite recent. Since Anita Begnaud became CEO in 2018, they’ve increased the ad valorem millage from 11.69 to 15 mills. That’s a twenty-eight percent (28%) increase in just three years. That tax increase percentage almost exactly corresponds to CEO Anita Begnaud’s salary and compensation increases.

Is past performance an indicator of future results?

If we follow this logic, that Anita Begnaud increased the tax twenty-eight percent (28%) over the last four years without voter approval, the math works out to about seven-percent (7%) per year. If we multiply seven-percent (7%) by the fifteen (15) years the tax will last, that’s means the potential for increase in the next fifteen years is a hundred-and-five percent (105%). That kind of increase on 15 mills is pretty simple math. It’s effectively double plus a little extra. For argument sake we’ll call it thirty (30) mills.

As a point of reference, the average City of Lafayette property (outside of the downtown district) is subject to about one-hundred (100) mills in ad valorem (property) taxes. Currently, it costs a business (or homeowner) fifteen-percent (15%) more to be located in the downtown district. After another fifteen (15) years, it could cost an extra thirty-percent (30%). The reason DDA was formed was to grow downtown. However, could there be a better incentive to leave downtown?

My, how the CEO’s salary has grown

CEO, Anita Begnaud, was originally hired to take the place of interim CEO Geoffrey Dyer in 2018. During her first full year on the job (2019), according to DDA’s 2019 annual audit, her total compensation was $120,729. The 2022 budget amount of $143,091 is an increase of about twenty-percent (20%). However, the 2020 annual audit (the most recent available) versus her 2020 budget amount shows she received about 7% more in compensation than was budgeted ($124,215 budgeted versus $132,660 actual compensation). If that standard holds for 2022, her total income could end up being $153,107, or a 32% pay raise!

We might have a better idea of her compensation when DDA releases its 2021 annual audit. However, that traditionally happens sometime in July or August – well after the April 30th decision voters will be making. Is that convenient timing just a coincidence? Let’s compare that question with another. Why didn’t she put this tax on the November ballot that doesn’t compete with the area’s largest festival and also includes a guaranteed higher-turnout election containing the very popular Congressman Clay Higgins and Senator John Kennedy? How about this one: why didn’t she put this tax on the ballot last year, like most responsible taxing authorities would have done?

Why not last year?

That question actually came up at both the City Council meeting and the State Bond Commission meeting. Most responsible taxing authorities put their operational taxes on the ballot years in advance. They do this because these taxes will fail sometimes. If they wait until the last minute, and it fails, it’s no longer designated as a “renewal” when they put it back on the ballot. However, if they do it years in advance, and it fails, they can still call it a renewal for several election attempts.

So, why didn’t she put it on the ballot in 2020 or 2021? Her answer was, “COVID.” Unfortunately, our dingy elected representatives on the City Council and the State Bond Commission ([cough] Page Cortez) only wanted an answer. They didn’t care that the answer made no sense and they didn’t dig any deeper. That’s because Louisiana held no fewer than four elections in 2020 and another five elections in 2021. In fact, November of 2021 saw an election with six Lafayette taxes and four Louisiana constitutional amendments. Why didn’t she put it on that ballot? No one pressed that question. Add to this, there have already been two elections in 2022! Why not one of those?

If there were nine elections in Louisiana between 2020 and 2021 despite COVID, and another two already in 2022 (January 15th and March 26th) what other reason might she have for preferring an April 30th ballot?

What’s clear is she really doesn’t want you voting at all

Well, for starters, Festival International was canceled both years. However, in 2022, Festival is happening smack in the middle of the downtown district and election day (April 30th) is Festival’s single biggest day! Another amazing coincidence!

We can assume Mrs. Begnaud’s financial position must be pretty solid considering on February 7th (the next business day after she submitted her tax increase to the Lafayette City Council) she purchased a brand new $50,000 “touring edition” (top of the line) automobile. However, if she had selected November of 2022 for the tax election, we’d have a much better picture because DDA’s 2021 annual report (including her 2021 salary and compensation) will have been released by then. Plus, we’d also be guaranteed a much better voter turnout thanks to the Congressional midterm elections. The April 30th decision reduces transparency and virtually guarantees a lower turnout. As we previously mentioned, if the turnout is four-percent (4%) like the 2007 Lafayette elections, it means that just 14 voters could decide this entire question.

But how can I say that she really doesn’t want you voting at all? That’s because in 2019, DDA’s CEO Anita Begnaud lobbied for and received an additional 1¢ sales tax for downtown Lafayette without voter approval. For reference, Article 6, Section 29 in our state constitution, and Article 2, Section 17-D in Lafayette’s home rule charter specifically forbids the practice of creating taxes without voter approval. However, deep within Revised Statute 33:9038.33 A, a fragment reads, “… in the event that there are no qualified electors in the district … no election shall be required.” What’s the solution? Gerrymandering. We told you all about this end-around the constitution and home rule charter as it was happening at the time, here and here.

A smoking gun

Co-published by Anita Begnaud’s DDA, “How We Compete” is a roadmap to raising taxes without voter consent.

Below is the absolute proof she doesn’t want you voting. It’s a Google map we created to clearly illustrate Anita Begnaud’s use of Jim Crow style gerrymandering to avoid voter input. All of this is in writing, too, by the way. Back in August of 2019, when Anita Begnaud had been DDA’s CEO for about a year, she co-published a blueprint for raising taxes by legal loophole titled, “How We Compete.” (If you’d prefer to download and print the document, we’ve also made it available in PDF format here.) Right there on the cover is DDA’s logo. If we turn to page five and six, it describes in vivid detail the very same process DDA’s CEO, Anita Begnaud, used to raise significant taxes by intentionally bypassing a vote of the people. From page six:

…the registrar of voters must certify that there are no qualified electors [voters] within the EDD boundaries; otherwise, there must be a favorable vote of the qualified electors [the voters must approve the tax]. Importantly, a new tax can be levied against existing businesses in an EDD as long as there are no voters registered with the same address.

In the map below, the dark red outline is the Commercial Core Subdistrict. That’s where the 15 mills ad valorem (property) tax (150% of original voter authorization) is being levied. The pink area is the gerrymandered 1¢ sales tax district. The blue dots are the approximate locations of all of the voters at the time. If you zoom in, you’ll clearly see that Anita Begnaud was successful in her written plan to intentionally bypass the voters to raise this additional 1¢ sales tax.

Anita Begnaud is making it rain!

It’s Lafayette Parish School Board’s responsibility to collect and remit all sales tax in Lafayette Parish. Therefore, a great place to look for how much money has been flowing freely into the Downtown Special Taxing District is the school system’s Lafayette Checkbook. As of this writing, Anita Begnaud’s gerrymandered taxing district has extracted an additional $790,160.08 from the downtown Lafayette area. That’s more than twice the annual ad valorem (property) tax collections that she’s been using to pay her own salary. Why does she need all of that money?

It’s Lafayette Parish School Board’s responsibility to collect and remit all sales tax in Lafayette Parish. Therefore, a great place to look for how much money has been flowing freely into the Downtown Special Taxing District is the school system’s Lafayette Checkbook. As of this writing, Anita Begnaud’s gerrymandered taxing district has extracted an additional $790,160.08 from the downtown Lafayette area. That’s more than twice the annual ad valorem (property) tax collections that she’s been using to pay her own salary. Why does she need all of that money?

Add to that, Downtown Lafayette Unlimited (DLU) is another, distinct downtown organization for which Anita Begnaud is also the CEO. DLU the 501(c)(3) that promotes and operates Downtown Alive. As of this writing, the latest publicly available IRS tax document for DLU is from 2019. According to line twelve (12) of that document, Anita Begnaud’s private organization recored an additional $438,893 in annual revenue! Wow! Why does she need all of that money?

“It’s not an increase, that’s misinformation!”

After we published the breaking news that the City of Lafayette rammed through a resolution raising downtown taxes by 50%, pro-tax Republican Denice Skinner and local malcontent Geoff Daily joined forces and exploded onto our comments section. They insisted that there was no increase because DDA has already been collecting more taxes than the voters had approved. Say, what?

You read that right. Not only has DDA used a loophole to gerrymander a new sales tax without voter approval, but they’ve also used another loophole to raise downtown property taxes without voter approval. Therefore, since they already raised the taxes, putting the higher rate on the ballot is not an increase. Are you following the pretzel twisting logic required to make such a ridiculous statement?

They absolutely have a first amendment right to stretch the truth without fear of getting into any serious trouble. Presenting facts in certain ways to make a tax increase appear more palatable – even desirable – to the public is standard practice of every tax’s beneficiaries. Thankfully, what’s not standard practice is extending the stretching of truth onto the ballot language itself.

That’s why, unlike the pro-tax crowd, we encourage you to not listen to anyone (including us), but to do your own due diligence. The reason is we already know where that research will take you. If all you read for yourself is the ballot language, it debunks their entire “not an increase” talking point. You don’t even have to go looking for it because I’ve posted it right there. We’ve even marked the part where they themselves agree with our assessment that this tax is absolutely an increase.

How much is too much?

Between the gerrymandered Downtown Economic Develoment District ($790,000), Downtown Lafayette Unlimited ($440,000), and Downtown Development Authority ($450,000), Anita Begnaud’s Downtown shakedown is up to $1.7 MILLION! That’s quite the wheelbarrow of cash flowing from Downtown Lafayette. Does Anita Begnaud even need that ad valorem (property) tax? Are downtown’s disrespected voters expected to overlook Anita Begnaud’s gerrymandering to avoid their input? Could Anita Begnaud’s demanding that area voters absorb another huge tax increase be a bridge too far? Will voters continue to support all of these salaries, side-benefits, and pay raises without question for another fifteen years?

###

If we’re not watching them, who will?

Citizens for a New Louisiana is the only organization in Louisiana dedicated to reforming local government. With the help of numerous volunteers we are making some progress. However, there’s much more work we could be doing. Making a difference will take a little more than reading an article every now and then. Your community doesn’t need another spectator. They need someone willing to step onto the field and become a real part of the solution. Will you join us?

Help us to achieve the vision of creating a new, propserous state by becoming a Citizen of a New Louisiana. Become a Citizen Make a Donation Tax Deductible Gifts