There is an extreme amount of misinformation flowing out of the Downtown Lafayette Unlimited organization (directed by DDA). As a result, we felt it best to send a letter to nearly every single household in the Downtown Taxing District. I’m publishing it here as an open letter for the benefit of our online transparency enthusiasts who reside outside of that district.

Dear resident,

They aren’t telling you the whole truth. Those Downtown Lafayette folks who’ve been walking door to door and asking you to vote for their tax hike have left off numerous pertinent details.

The Commercial Core District is only one of two major downtown taxing districts. Louisiana’s legislature approved it in 1983 and allowed for a property tax (ad valorem) millage “not to exceed 10 mills.” They’re not telling you that Downtown Development Authority (DDA) didn’t even have a tax for the first ten years of its existence. It wasn’t until 1993 that voters approved a property tax.

It was just recently that DDA figured out how to use a legal loophole to increase that tax all the way to 15.06 mills without even bothering to tell you about it. That’s a 50% increase over what was authorized by state law.

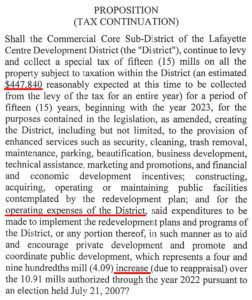

What’s worse is in 2013 the tax was set at 9.6 mills. But in 2022, it’s now 15.06 mills. That’s a 57% increase in the rate of taxation in just ten years! For the same period, there is a dollar increase as well: going from $385,122 in 2013 to $447,840 budgeted for 2022.

But how can they say, “no one’s tax bills will increase because this millage is renewed?”

That’s a nod to the legal loophole they used to raise the tax over the last few years. You won’t pay any more than you did last year is technically true. However, when we look back at the ten-years’ worth of increases, this statement is only telling you part of the truth.

Another thing they don’t want you to know is outside the downtown taxing district, an average City of Lafayette resident pays about 100 mills in property tax (ad valorem) every year. The downtown millage is currently an additional 15; for a total of 115 mills. The very simple math shows when it comes to property taxes, it costs 15% more to live downtown.

But that’s just the beginning. In the next few pages, I’ll outline two additional taxes they snuck in while you weren’t looking.

The “show up for downtown” team has an example of how much this property tax will supposedly cost an average person. It can be found in the “WHAT” section of their website. “A homeowner who lives in the Downtown Development Authority district, in a house valued at $170,000, pays less than $12/month for the downtown millage.” The math on that works out to $144 in additional annual taxes. Something else they’re not volunteering is whether that number only applies to someone claiming homestead exemption. For renters, that rate could be $21 per month, or $252 in additional taxes that’s passed onto them by their landlord.

To show you what I mean by “additional taxes,” I pulled a home in the area valued at $177,000 and the total property taxes paid in 2021 was $2,130.21. Ten years ago, the same property only paid $1,694.82. Homestead exemption on a similar property would be $1,223.55 (increased from only $974.21 ten years ago). So, telling you, “It’s only $12” isn’t the whole truth.

Do you know what they’re doing with the tax money once it comes in? Salaries and benefits. Of the $447,840 the tax is set to bring in this year, over 90% of it ($406,348) will go straight to employee compensation. In fact, the CEO of Downtown Lafayette is budgeted to receive $143,092 in total compensation this year. That’s nearly a 19% pay raise since she started in 2019.

Downtown Development Authority – thinking of new ways to tax you more.

The second taxing district (the one they hope you forget) is the “Downtown Economic Development District.” That’s where they figured out how to charge you an extra 1¢ sales tax on everything you buy and an extra 2¢ occupancy tax! As of January 31st, these new taxes have extracted $786,547.68 from downtown’s economy.

This new taxing district was just created in 2019 at the request of Lafayette’s Downtown Development Authority (DDA). Normally, you would have had to vote in an election to approve a tax like this. However, they gerrymandered the map to remove voters, specifically to avoid having to hold an election!

The map image on this page shows the property tax district (dark outline), the sales tax district (the pink area), and the voters that were gerrymandered out of the sales tax district (blue dots) to avoid a state law that says voters must approve all new taxes. However, if there are no voters in the district, no election is required! And that’s exactly what DDA did in 2019.

Frequently Asked Questions

Q: Who is DDA?

A: DDA is the Downtown Development Authority, a taxing authority created by special act of the legislature in 1983. Even though they’re asking voters to approve a property tax rate of 15 mills, state law says their tax rate is “not to exceed 10 mills.”

Q: Is this a tax increase?

A: Yes. Even though some have said “no,” the ballot language confirms that this is an increase.

Q: What does this tax pay for?

A: Of the $447,840 the tax is set to bring in this year, over 90% of it ($406,348) will go straight to salaries and compensation. In fact, the CEO of Downtown Lafayette is budgeted to receive $143,092 in total compensation this year. That’s a 19% pay raise since 2019.

Q: How often does this property tax come up for a vote?

A: This opportunity only comes along once every fifteen (15) years.

Q: How often does the downtown sales tax come up for a vote?

A: Never. The DDA specifically designed it so that it will never be voted on. However, the tax will likely come before the city council for renewal on or before July 1, 2045.

Q: What happens if the property tax passes?

A: For the first year, the property tax will be levied at the new “voter approved’ rate of 15 mills. Afterwards, they can “adjust” the rate higher without your approval with the same legal loophole they’ve been using. For example, in 2013 they levied 9.7 mills. In 2022, the tax has been increased to 15 mills. This huge increase happened without your knowledge or approval.

Q: What happens if the property tax fails?

A: Likely, they’ll just put it right back on the ballot for the November election. If that happens, hopefully they’ll follow state law and ask for the statutorily correct rate of 10 mills.

Q: If the property tax fails, what happens to Festival International?

A: Nothing. Festival International is not operated by DDA, but a completely unrelated non-profit organization named “Festival International De Louisiane.”

Q: If the property tax fails, what happens to Downtown Alive?

A: Nothing should happen because Downtown Alive is not operated by DDA, but a distinctly separate organization called “Downtown Lafayette Unlimited.”

Q: When is this election?

A: Election day is scheduled for Festival International’s busiest day, Saturday, April 30th. If you plan to participate in this election, it’s recommended that you do so early. On Saturday, April 16th, or between Monday April 18th and Saturday April 23rd (polls will not be open on Sunday, April 17th). Early voting takes place downtown at 1010 Lafayette Street.

This is the only item on your ballot. Because there are no other elections in Lafayette Parish, holding this downtown-only election has cost downtown taxpayers $10,000